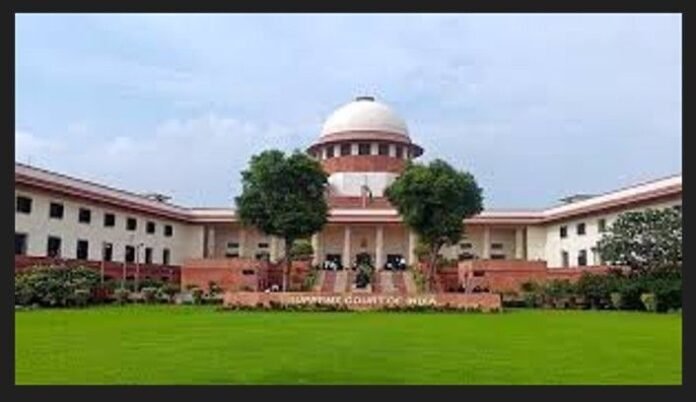

New Delhi, February 10, 2026: The Supreme Court of India has directed the Central Bureau of Investigation (CBI) to probe the role of senior bank officials involved in sanctioning loans to Reliance Communication Ltd. (RCOM), shifting focus toward the conduct of lenders in one of the country’s significant financial default cases.

In its order dated February 4, 2026, the apex court instructed the CBI to examine whether financial assistance extended to the defaulting company was released through collusion or connivance between bank authorities and the company’s management. The directive emphasises a thorough investigation into the decision-making process behind the sanctioning and disbursement of loans.

According to sources, a consortium of 14 public sector banks had extended financial support to RCOM. The Court has mandated the CBI to scrutinise whether any bank officials acted in conspiracy or collusion with the corporate entity during the lending process.

Significantly, the Supreme Court clarified that Section 17A of the Prevention of Corruption Act cannot be cited as a barrier to initiating investigations against bank officials. In Point No. 7 of its order, the Court observed:

“It is imperative upon the CBI to investigate the conduct of the bank authorities to determine whether financial assistance was released in collusion and connivance with the management of the defaulter company… We direct that, regardless of any such provision, the CBI must look into the nexus/collusion/connivance/conspiracy, if any, and adopt all lawful measures for taking the investigations to their logical conclusions.”

The ruling underscores that no statutory provision should be used to obstruct or dilute inquiries into alleged collusive arrangements between banks and corporate borrowers. The Court authorised the CBI to employ all lawful and appropriate measures to ensure a comprehensive investigation.

Further, the Supreme Court stressed that accountability within financial institutions and among public officials is critical to maintaining the integrity of the banking system. It also noted that procedural technicalities must not be allowed to shield potential financial misconduct, reiterating that investigations into serious financial irregularities must proceed independently and without impediment.